Welcome to the Covington County Revenue Commissioner's page. Please feel free to contact us if we can be of service to you.

Revenue Commissioner: George L. Patterson Jr. (Chuck)

Covington County Courthouse

1 N. Court Square, Andalusia, Alabama 36420

Phone: 334-428-2540 Direct ext. 334-428-2546

Fax: 334-428-2575

|

George L. "Chuck" Patterson, Jr

Revenue Commissioner

|

The Revenue Commissioner's Office serves the taxpayers of Covington County. The Revenue Commissioner is responsible for the Appraisal, Assessment, Collection and disbursement of property taxes for each parcel of land within the county, as well as Business Personal Property for businesses with assets located in Covington County.

Our hours of operations are Monday thru Friday, 8:00 AM to 5:00 PM. We are closed on the same days as the Covington County Commission Holidays.

|

|

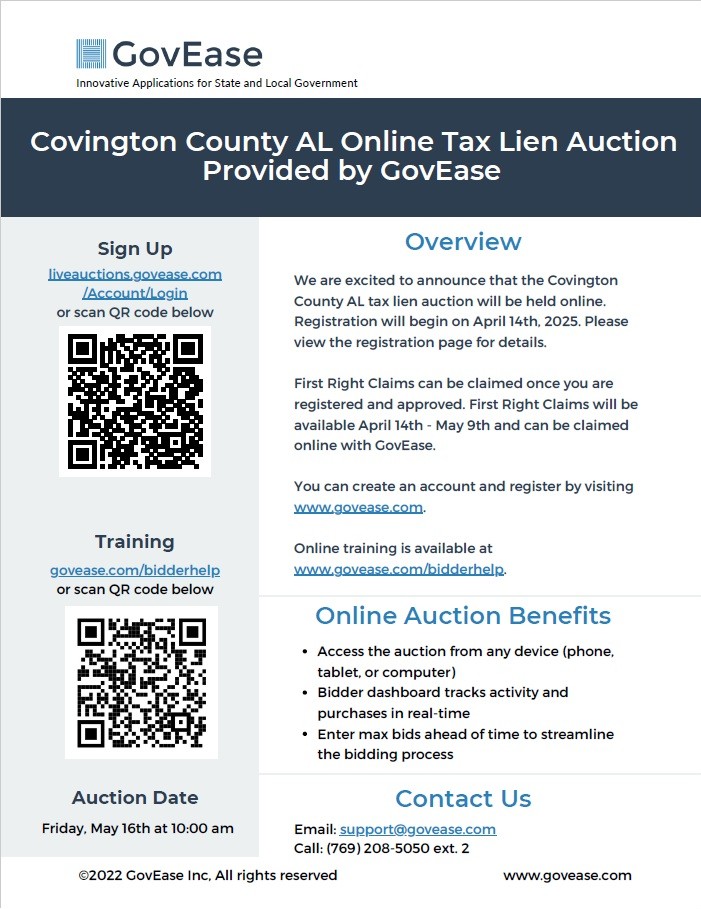

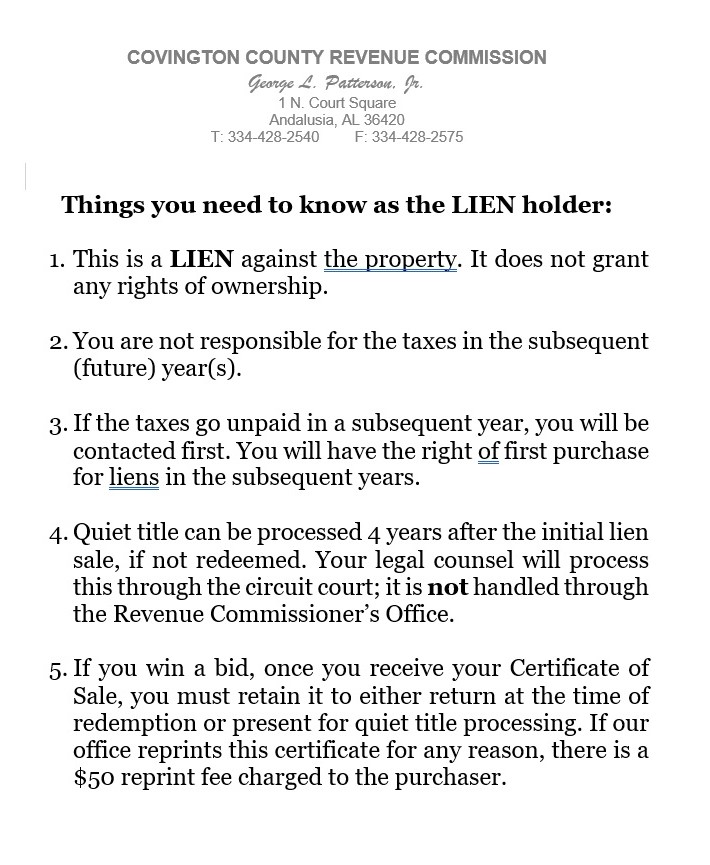

Please Click the Links Below to Download the Alabama GovEase Auction's General Rules and Tax Lien List

|

Online Auction Rules

|

Delinquent Tax Lien Sale

(Updated 04/29/2025)

|

Late Property Call

(Updated 04/29/2025)

|

EXEMPTIONS ON PROPERTY TAX AVAILABLE

All exemptions must be APPLIED for by the Owner/Deed Holder

-

Homestead Exemption (Primary Residence)

- Normal Homestead

- Over 65 Years Old (Age & Income)

- 100% Disability through SSA/VA/Physician Affidavits

- Personal Use/Summer Home – Not for rent/sale/lease

- Current Use – Agricultural or Timber land

- Grain Bins In Use Exemption

For information on how to qualify for and apply for these exemptions, please contact the Covington County Revenue Commissioner’s Office. Applications are available and accepted year-round. Alabama’s lien date is October 1 each year, and all applications are due by December 31. The application may apply to the NEXT tax year, depending on the time of filing. We will gladly inform you of what year to expect the exemption to be applied, as we do not operate in a regular calendar year.

Property mapping and details can be found at: ALABAMA FLAGSHIP GIS. Here you may view detailed information as well as street level photos of parcels located in the listed counties.

*****Payments and Property details can be found by following the links to "PAY PROPERTY TAXES".

Information and Updates are available from our office in the following locations:

- The Covington County Courthouse

- The Covington County Administrative Building

- In articles published in local newspapers throughout the year

- On local radio stations

- Our Covington County Revenue Commissioner’s Office Facebook page

COURT HOUSE OFFICE

ASSESSMENT OFFICE:

- GENERAL QUESTIONS

- EXEMPTION APPLICATIONS

- UPDATE CONTACT DETAILS

- ACCOUNT CREATION

ASSESSMENT CLERKS:

AMBER GAY 334-428-2541

KELSEY DOUGHTIE 334-428-2542

COLLECTIONS OFFICE:

- PAYMENTS

- MOBILE HOME REGISTRATION

- GENERAL QUESTIONS

- UPDATE CONTACT DETAILS

COLLECTION CLERKS:

TRICIA WATKINS 334-428-2545

KIM ERNSTES 334-428-2544

CHIEF REVENUE CLERK:

BETH TURNER 334-428-2543

**** For Information Regarding Homestead Exception, Please CLICK HERE ****

For Additional Information and Answers to your Questions, Please CLICK HERE

TAX LIEN AUCTION NOTICE

Code of Alabama TITLE 40-10-180 (b)

The tax collecting official of each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien or the sale of property to collect delinquent property taxes and the method decided shall apply to all property in that county for that year and future years unless notice is given that changes the method as prescribed.

Code of Alabama TITLE 40-10-180 (c)

George L. Patterson, Jr., as the Revenue Commissioner and tax collecting official for Covington County, does hereby declare and give notice that the Covington County Revenue Commission will conduct a Tax Lien Auction for the collection of delinquent property taxes for the year 2023-2024 forward.

|

2023 Equalization Sales Ratio Study

|

2023 ADOR Sales Ratio Study for Covington County

2024 Tax Collection

|

Appraisal to Tax Calculation

|